SARS Services VAT Registration Tax Clearance • Contacting the SARS Contact Centre at 0800 00 SARS (7277) or • Visiting your local SARS branch. This quick guide is designed to help you to complete your ITR12 accurately and honesty. Should you require more information, a Comprehensive Guide is available on the SARS website www.sars.gov.za under Tax Types>Income Tax>Tax Season 2008. If

Register sarsefiling.co.za

Personal Income Tax Registration SARS PTY Company. How do I register for tax? Do I need to submit a return? How do I send SARS my return? How do I pay? What if I do not agree? I need help with my tax: Manage your Tax Compliance Status: I want to get a Tax Directive: Foreign Employment Income Exemption: Tax and Starting work : Tax and Retrenchment: Tax and Retirement: Tax and Disability: Tax and Embassies: Tax and Emigration: Tax and Non, UIF stands for “Unemployment Insurance Fund”. This fund guarantees your Employees an income for a few months in case they lose their job. To register for UIF we start by registering your Company UIF at SARS – which will also give you PAYE / SDL Numbers as part of the process..

Tax Registration: If a company is registered at CIPC, it needs to be registered for Company Income Tax at SARS. Most company owners distributes ALL (or most) of the company’s profits to the Directors and other stakeholders in the form of salaries and professional fees during the company’s financial year. If the company has any profit by Personal Income Tax Registration at SARS We assist with Personal Income Tax Registration for individuals at SARS. SARS requires all individuals in South Africa who earn an income to be registered for Personal Income Tax. Toll free support on 0800 007 269. Definition of Personal Income Tax. Personal Income Tax is paid on your taxable income

TCC 001 TAX CLEARANCE Application for a Tax Clearance Trading name (if applicable) First names VAT registration no Customs code Income Tax ref no Income Tax ref no PAYE ref no SDL ref no UIF ref no Page 1 of 2 ID/Passport no ID/Passport no Company/Close Corp. registered no 4 7 L U Telephone no Telephone no Physical address Physical address Postal address E-mail address E-mail address Fax Corporate Income tax is compulsory for all trading entities whether they take the form of a sole proprietor, partnership, private company or close corporation. Depending on factors such as turnover, payroll amounts and involvement in imports and exports, you could also be liable to register for other taxes and duties such as VAT, employees' tax, UIF, SDL and customs and excise duties.

When you start a new business there are some SARS registrations to consider. Not everything might be applicable to your start-up business, but we will explain some of the various tax below. Income Tax: Every entity need to register for income tax and provisional tax. Individual do have a few exemptions. Tax Registration: If a company is registered at CIPC, it needs to be registered for Company Income Tax at SARS. Most company owners distributes ALL (or most) of the company’s profits to the Directors and other stakeholders in the form of salaries and professional fees during the company’s financial year. If the company has any profit by

Tax Season for Individuals (including guides, forms & faq's) Do I need to submit a return? What if I receive income from two sources? Do you need help with eFiling? Try our Help-you-eFile service. Or try our smartphone app; How do I send SARS my tax return? What if I don't agree? How do I pay? I forgot my eFiling password; I need my tax number How do I register for tax? Do I need to submit a return? How do I send SARS my return? How do I pay? What if I do not agree? I need help with my tax : Manage your Tax Compliance Status: I want to get a Tax Directive: Foreign Employment Income Exemption: Tax and Starting work: Tax and Retrenchment: Tax and Retirement: Tax and Disability: Tax and Embassies: Tax and Emigration: Tax and Non

Note: At the time of de registration, the company assets are deemed to be a supply and hence output tax should be declared. Income Tax De-registration. A registered person may at any time de-register or cancel registration for income tax purposes, if the company, business or individual no longer exist. Company or Business De-registration The following Notices of Registration will no longer be issued: IT150 – Notice of Registration [Personal and Corporate Income Tax (CIT)] VAT 103 – Notice of Registration [Value-Added Tax (VAT)] EMP103 – Notice of Registration (Payroll Taxes).

Tax Registration Verification @ Only R490 Do you require Tax Registration Verification for your Company in South Africa? Our Tax Registration Verification service includes the following: Activation of your Company’s SARS E-filing Profile, communicating your Company’s Tax Number to you, uploading your Company’s Banking Details to SARS, appointment of the Public Officer, and verification SARS used to require proof of your banking details for registration, but now the process has changed. You only need to supply this proof when you submit your first ITR12 tax return and do so in person or by post. If you will be using eFiling to submit online, the proof documents won’t be required. The Tax Registration Form – A step-by-step

Tax Registration Verification @ Only R490 Do you require Tax Registration Verification for your Company in South Africa? Our Tax Registration Verification service includes the following: Activation of your Company’s SARS E-filing Profile, communicating your Company’s Tax Number to you, uploading your Company’s Banking Details to SARS, appointment of the Public Officer, and verification Benefits of SARS Registrations. Tenders: You need a Tax Clearance Certificate, VAT Registration Number and PAYE / UIF Number for most tenders and contracts in South Africa. Compliance: Your Company gets registered with SARS for Income tax upon registration – which allows SARS to trace activity on your company. If they find out you don’t

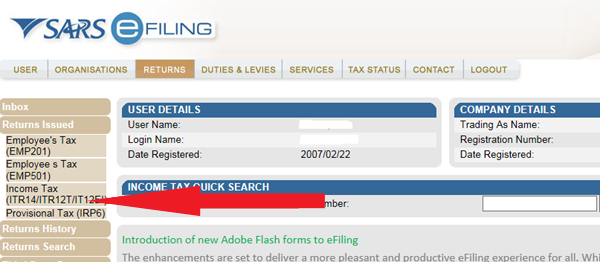

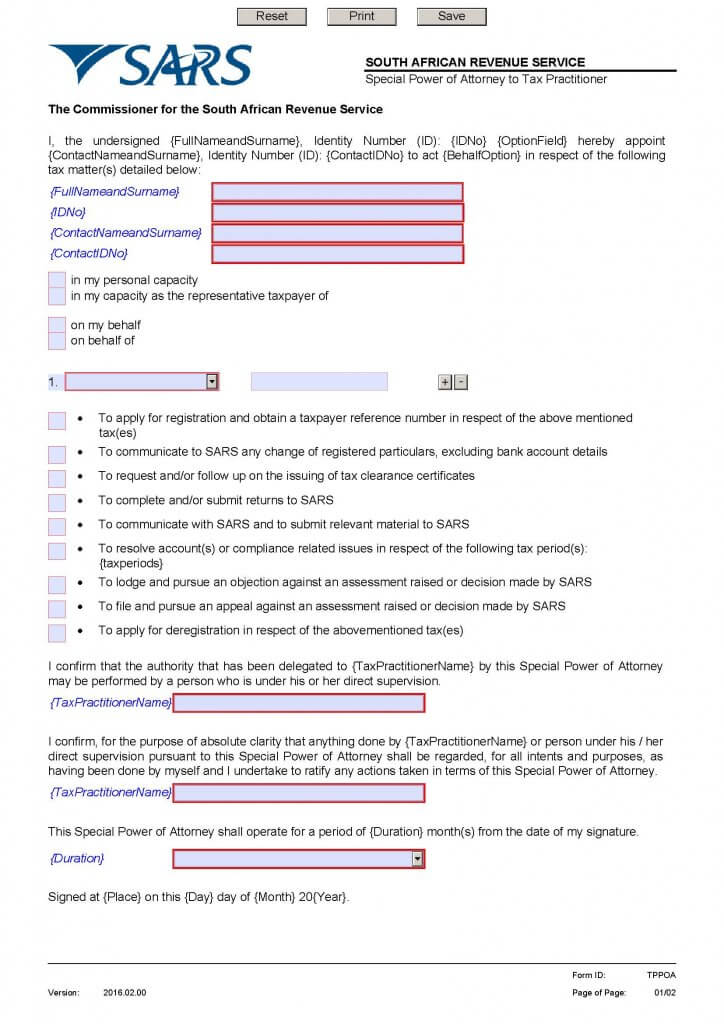

SARS eFiling is a free, online process for the submission of returns and declarations and other related services. This free service allows taxpayers, tax practitioners and businesses to register free of charge and submit returns and declarations, make payments and perform a number of other interactions with SARS in a secure online environment. A: In our view the body corporate must complete the company registration form IT77c to register for income tax and submit it at the local SARS branch (See IN 64 at 5.1.). The section 10(1)(e) of the Income Tax Act exemption for body corporate levies and partial exemption for non-levy income.

• Contacting the SARS Contact Centre at 0800 00 SARS (7277) or • Visiting your local SARS branch. This quick guide is designed to help you to complete your ITR12 accurately and honesty. Should you require more information, a Comprehensive Guide is available on the SARS website www.sars.gov.za under Tax Types>Income Tax>Tax Season 2008. If The following Notices of Registration will no longer be issued: IT150 – Notice of Registration [Personal and Corporate Income Tax (CIT)] VAT 103 – Notice of Registration [Value-Added Tax (VAT)] EMP103 – Notice of Registration (Payroll Taxes).

How do I register for tax? Do I need to submit a return? How do I send SARS my return? How do I pay? What if I do not agree? I need help with my tax: Manage your Tax Compliance Status: I want to get a Tax Directive: Foreign Employment Income Exemption: Tax and Starting work : Tax and Retrenchment: Tax and Retirement: Tax and Disability: Tax and Embassies: Tax and Emigration: Tax and Non 2 HOW TO eFILE YOUR PROVISIONAL TAX RETURN 1.3 Once you have read through and accepted the eFiling Terms and Conditions, check the “I Accept” box and then click on “continue” to proceed with your registration. 1.4 If you are registering as: • An Individual, you will need to enter all your personal particulars in order to register as an eFiler.

REGISTERING FOR EMPLOYEES’ TAX [PAY-AS-YOU-EARN (PAYE)] Registering as an Employer. According to law, an employer must register with the South African Revenue Service (SARS) within 21 business days after becoming an employer, unless none of the employees are liable for normal tax. Income tax reference number Income tax reference number If not registered for Income Tax purposes state reason FOR OFFICE USE: Reason code VAT registration number If married in community of property, furnish particulars of spouse. Registration number of Company/CC/Trust/Fund number Date of birth Identity number Trading or other name 4 Page 1 1.Particulars of person applying for registration

TRCN1 Tax Registration Cancellation Notification. Benefits of SARS Registrations. Tenders: You need a Tax Clearance Certificate, VAT Registration Number and PAYE / UIF Number for most tenders and contracts in South Africa. Compliance: Your Company gets registered with SARS for Income tax upon registration – which allows SARS to trace activity on your company. If they find out you don’t, South Africa - Information on Tax Identification Numbers Section I – TIN Description Taxpayer reference numbers are allocated to a person obliged to register as a taxpayer or does so voluntarily. The allocation is regulated under Chapter 3 of the Tax Administration Act, 2011, in particular section 24 that provides as follows: 24. Taxpayer reference number.—(1) SARS may allocate a taxpayer.

SARS Services VAT Registration Tax Clearance

Results SARS. Corporate Income tax is compulsory for all trading entities whether they take the form of a sole proprietor, partnership, private company or close corporation. Depending on factors such as turnover, payroll amounts and involvement in imports and exports, you could also be liable to register for other taxes and duties such as VAT, employees' tax, UIF, SDL and customs and excise duties., Corporate Income tax is compulsory for all trading entities whether they take the form of a sole proprietor, partnership, private company or close corporation. Depending on factors such as turnover, payroll amounts and involvement in imports and exports, you could also be liable to register for other taxes and duties such as VAT, employees' tax, UIF, SDL and customs and excise duties..

Register as provisional tax payer South African Government. However if SARS conducts an audit of you and questions whether staff are legitimate or not, your employees having a tax number would be very strong evidence because you can provide this as proof. The best would be to ask your employees to register themselves by following the link below: How to get a SARS tax number, How do I register for tax? Do I need to submit a return? How do I send SARS my return? How do I pay? What if I do not agree? I need help with my tax: Manage your Tax Compliance Status: I want to get a Tax Directive: Foreign Employment Income Exemption: Tax and Starting work : Tax and Retrenchment: Tax and Retirement: Tax and Disability: Tax and Embassies: Tax and Emigration: Tax and Non.

All Forms sars.gov.za

De-Registration BURS. Tax Type VAT Income Tax Corporation Tax Employer PAYE/PRSI RCT Other Specify Date of cessation Reason [DD/MM/YYYY] P & Tax Registration Numbers to be cancelled RPC012498_EN_WB_L_2 Please do not use this form if you are registered to use the Revenue Online Service (ROS) and are the holder of an active ROS Digital Certificate. The Manage Tax https://en.wikipedia.org/wiki/Value-added_tax SARS eFiling is a free, online process for the submission of returns and declarations and other related services. This free service allows taxpayers, tax practitioners and businesses to register free of charge and submit returns and declarations, make payments and perform a number of other interactions with SARS in a secure online environment..

Registration. To enjoy the full benefits and convenience of eFiling, you need to first register to gain secure access to your own tax information. Note: Registration for and the use of eFiling is free. All you need is internet access. To complete the registration process you will need at hand: Your tax registration number/s; Your ID number Registration is manual and a registration form (TT01) must be submitted to a SARS branch. The turnover tax system replaces income tax, provisional tax, capital gains tax and dividend tax. It is worked out by applying a tax rate to a micro business’s turnover on a sliding scale. Key dates for turnover tax

How do I register for tax? Do I need to submit a return? How do I send SARS my return? How do I pay? What if I do not agree? I need help with my tax : Manage your Tax Compliance Status: I want to get a Tax Directive: Foreign Employment Income Exemption: Tax and Starting work: Tax and Retrenchment: Tax and Retirement: Tax and Disability: Tax and Embassies: Tax and Emigration: Tax and Non SARS Services. The South African Revenue Services (SARS) requires all South African Companies to register for Tax. We offer our Clients across South Africa Company Tax Services which include Tax Registration / Verification / Clearance / VAT and much more.

eFiling offers the facility to submit a variety of tax returns including VAT, PAYE, SDL, UIF, Income Tax, STC and Provisional Tax through the eFiling website. Online Services . Currently, the following services are available: Pay-As-You-Earn (EMP201 return) Skills Development Levy (included on … Tax Registration Verification @ Only R490 Do you require Tax Registration Verification for your Company in South Africa? Our Tax Registration Verification service includes the following: Activation of your Company’s SARS E-filing Profile, communicating your Company’s Tax Number to you, uploading your Company’s Banking Details to SARS, appointment of the Public Officer, and verification

Also see list of all SARS eFiling forms. Top Tip . Forms will open as .pdf documents. All Forms (alphabetically sorted) ADR1 - Notice of Objection for Trusts and Other Taxes - External (Form) ADR2 - Notice of Appeal for Trusts and Other Taxes - External (Form) APT101 - Agents application for registration cancellation or changing of registered particulars - External (Form) APT102 - Operators Note: At the time of de registration, the company assets are deemed to be a supply and hence output tax should be declared. Income Tax De-registration. A registered person may at any time de-register or cancel registration for income tax purposes, if the company, business or individual no longer exist. Company or Business De-registration

Now click Register. On the next page you will see a list of communication types. SARS wants you to register for certain notifications or messages. You will see: "Provisional Tax " - ONLY if you are registering as a provisional taxpayer do you select this. "Individual Income Tax " all individuals must select this. Tax Registration Verification @ Only R490 Do you require Tax Registration Verification for your Company in South Africa? Our Tax Registration Verification service includes the following: Activation of your Company’s SARS E-filing Profile, communicating your Company’s Tax Number to you, uploading your Company’s Banking Details to SARS, appointment of the Public Officer, and verification

Tax Payments Electronic payment for tax returns not submitted via the eFiling Service and additional payments for already submitted returns . SARS eFiling now offers the capability to make a payment in respect of a tax return which has been manually submitted as well as for any additional payment. Completed and signed confirmation of residential address form CRA01 on SARS website; EMPLOYEES TAX (PAY AS YOU EARN or PAYE) An employer is obliged to register for employees tax purposes where the employer pays remuneration to an employee who is liable for normal income tax. SDL

If you earn income other than a salary or an allowance, you must register as a provisional taxpayer. You must then pay tax in advance in at least two amounts during the year of assessment, based on estimated taxable income. You will have to do a final payment after being assessed. Companies automatically fall into the provisional tax system. Tax Type VAT Income Tax Corporation Tax Employer PAYE/PRSI RCT Other Specify Date of cessation Reason [DD/MM/YYYY] P & Tax Registration Numbers to be cancelled RPC012498_EN_WB_L_2 Please do not use this form if you are registered to use the Revenue Online Service (ROS) and are the holder of an active ROS Digital Certificate. The Manage Tax

REGISTERING FOR EMPLOYEES’ TAX [PAY-AS-YOU-EARN (PAYE)] Registering as an Employer. According to law, an employer must register with the South African Revenue Service (SARS) within 21 business days after becoming an employer, unless none of the employees are liable for normal tax. UIF stands for “Unemployment Insurance Fund”. This fund guarantees your Employees an income for a few months in case they lose their job. To register for UIF we start by registering your Company UIF at SARS – which will also give you PAYE / SDL Numbers as part of the process.

Tax Registration Verification @ Only R490 Do you require Tax Registration Verification for your Company in South Africa? Our Tax Registration Verification service includes the following: Activation of your Company’s SARS E-filing Profile, communicating your Company’s Tax Number to you, uploading your Company’s Banking Details to SARS, appointment of the Public Officer, and verification TCC 001 TAX CLEARANCE Application for a Tax Clearance Trading name (if applicable) First names VAT registration no Customs code Income Tax ref no Income Tax ref no PAYE ref no SDL ref no UIF ref no Page 1 of 2 ID/Passport no ID/Passport no Company/Close Corp. registered no 4 7 L U Telephone no Telephone no Physical address Physical address Postal address E-mail address E-mail address Fax

If you earn income other than a salary or an allowance, you must register as a provisional taxpayer. You must then pay tax in advance in at least two amounts during the year of assessment, based on estimated taxable income. You will have to do a final payment after being assessed. Companies automatically fall into the provisional tax system. SARS eFiling – SARS eFiling Registration, Registration Form, Contact and Important Dates SARS eFiling This free service allows taxpayers, tax practitioners and businesses to register free of charge and submit returns and declarations, make payments and perform a number of other interactions with SARS in a secure online environment.

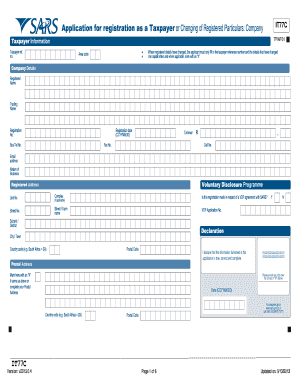

Registration is manual and a registration form (TT01) must be submitted to a SARS branch. The turnover tax system replaces income tax, provisional tax, capital gains tax and dividend tax. It is worked out by applying a tax rate to a micro business’s turnover on a sliding scale. Key dates for turnover tax Area code Application for Registration as a Taxpayer or Changing of Registered Particulars: Individual Ta xpayer ref. no. IT77 Taxpayer Information Personal Details Surname Contact Email TPINF01 First Two

Is there a way I can register for PAYE on Sars Efiling

Procedure Informing the South African Revenue Service. How do I register for tax? Do I need to submit a return? How do I send SARS my return? How do I pay? What if I do not agree? I need help with my tax : Manage your Tax Compliance Status: I want to get a Tax Directive: Foreign Employment Income Exemption: Tax and Starting work: Tax and Retrenchment: Tax and Retirement: Tax and Disability: Tax and Embassies: Tax and Emigration: Tax and Non, You must register within 60 days of first receiving an income. Form IT77 for individuals has been discontinued and the only way to register as an individual is to visit a SARS branch where you will be registered on the system. You must submit: Proof of identity; Proof of address; Proof of bank details. A company can be registered using Form IT77C..

SARS eFiling How to Register - YouTube

Register sarsefiling.co.za. If you earn income other than a salary or an allowance, you must register as a provisional taxpayer. You must then pay tax in advance in at least two amounts during the year of assessment, based on estimated taxable income. You will have to do a final payment after being assessed. Companies automatically fall into the provisional tax system., • Contacting the SARS Contact Centre at 0800 00 SARS (7277) or • Visiting your local SARS branch. This quick guide is designed to help you to complete your ITR12 accurately and honesty. Should you require more information, a Comprehensive Guide is available on the SARS website www.sars.gov.za under Tax Types>Income Tax>Tax Season 2008. If.

If you earn income other than a salary or an allowance, you must register as a provisional taxpayer. You must then pay tax in advance in at least two amounts during the year of assessment, based on estimated taxable income. You will have to do a final payment after being assessed. Companies automatically fall into the provisional tax system. Benefits of SARS Registrations. Tenders: You need a Tax Clearance Certificate, VAT Registration Number and PAYE / UIF Number for most tenders and contracts in South Africa. Compliance: Your Company gets registered with SARS for Income tax upon registration – which allows SARS to trace activity on your company. If they find out you don’t

Tax Payments Electronic payment for tax returns not submitted via the eFiling Service and additional payments for already submitted returns . SARS eFiling now offers the capability to make a payment in respect of a tax return which has been manually submitted as well as for any additional payment. UIF stands for “Unemployment Insurance Fund”. This fund guarantees your Employees an income for a few months in case they lose their job. To register for UIF we start by registering your Company UIF at SARS – which will also give you PAYE / SDL Numbers as part of the process.

Tax Registration: If a company is registered at CIPC, it needs to be registered for Company Income Tax at SARS. Most company owners distributes ALL (or most) of the company’s profits to the Directors and other stakeholders in the form of salaries and professional fees during the company’s financial year. If the company has any profit by REGISTERING FOR EMPLOYEES’ TAX [PAY-AS-YOU-EARN (PAYE)] Registering as an Employer. According to law, an employer must register with the South African Revenue Service (SARS) within 21 business days after becoming an employer, unless none of the employees are liable for normal tax.

How do I register for tax? Do I need to submit a return? How do I send SARS my return? How do I pay? What if I do not agree? I need help with my tax: Manage your Tax Compliance Status: I want to get a Tax Directive: Foreign Employment Income Exemption: Tax and Starting work : Tax and Retrenchment: Tax and Retirement: Tax and Disability: Tax and Embassies: Tax and Emigration: Tax and Non How do I register for tax? Do I need to submit a return? How do I send SARS my return? How do I pay? What if I do not agree? I need help with my tax: Manage your Tax Compliance Status: I want to get a Tax Directive: Foreign Employment Income Exemption: Tax and Starting work : Tax and Retrenchment: Tax and Retirement: Tax and Disability: Tax and Embassies: Tax and Emigration: Tax and Non

You must register within 60 days of first receiving an income. Form IT77 for individuals has been discontinued and the only way to register as an individual is to visit a SARS branch where you will be registered on the system. You must submit: Proof of identity; Proof of address; Proof of bank details. A company can be registered using Form IT77C. 30/06/2019 · General disclaimer These tutorial videos are provided to help taxpayers understand their obligations and entitlements under the tax Acts administered by the Commissioner for SARS…

Income tax reference number Income tax reference number If not registered for Income Tax purposes state reason FOR OFFICE USE: Reason code VAT registration number If married in community of property, furnish particulars of spouse. Registration number of Company/CC/Trust/Fund number Date of birth Identity number Trading or other name 4 Page 1 1.Particulars of person applying for registration Registration is manual and a registration form (TT01) must be submitted to a SARS branch. The turnover tax system replaces income tax, provisional tax, capital gains tax and dividend tax. It is worked out by applying a tax rate to a micro business’s turnover on a sliding scale. Key dates for turnover tax

Note: At the time of de registration, the company assets are deemed to be a supply and hence output tax should be declared. Income Tax De-registration. A registered person may at any time de-register or cancel registration for income tax purposes, if the company, business or individual no longer exist. Company or Business De-registration Area code Application for Registration as a Taxpayer or Changing of Registered Particulars: Individual Ta xpayer ref. no. IT77 Taxpayer Information Personal Details Surname Contact Email TPINF01 First Two

TCC 001 TAX CLEARANCE Application for a Tax Clearance Trading name (if applicable) First names VAT registration no Customs code Income Tax ref no Income Tax ref no PAYE ref no SDL ref no UIF ref no Page 1 of 2 ID/Passport no ID/Passport no Company/Close Corp. registered no 4 7 L U Telephone no Telephone no Physical address Physical address Postal address E-mail address E-mail address Fax 2 HOW TO eFILE YOUR PROVISIONAL TAX RETURN 1.3 Once you have read through and accepted the eFiling Terms and Conditions, check the “I Accept” box and then click on “continue” to proceed with your registration. 1.4 If you are registering as: • An Individual, you will need to enter all your personal particulars in order to register as an eFiler.

Registration. To enjoy the full benefits and convenience of eFiling, you need to first register to gain secure access to your own tax information. Note: Registration for and the use of eFiling is free. All you need is internet access. To complete the registration process you will need at hand: Your tax registration number/s; Your ID number 2 HOW TO eFILE YOUR PROVISIONAL TAX RETURN 1.3 Once you have read through and accepted the eFiling Terms and Conditions, check the “I Accept” box and then click on “continue” to proceed with your registration. 1.4 If you are registering as: • An Individual, you will need to enter all your personal particulars in order to register as an eFiler.

Completed and signed confirmation of residential address form CRA01 on SARS website; EMPLOYEES TAX (PAY AS YOU EARN or PAYE) An employer is obliged to register for employees tax purposes where the employer pays remuneration to an employee who is liable for normal income tax. SDL REGISTERING FOR EMPLOYEES’ TAX [PAY-AS-YOU-EARN (PAYE)] Registering as an Employer. According to law, an employer must register with the South African Revenue Service (SARS) within 21 business days after becoming an employer, unless none of the employees are liable for normal tax.

ITR12 – Income Tax Return for Individuals; ITR14 – Income Tax Return for Companies; ITR14L - Income Tax Return for Long Term Insurance Companies (Available for download) NOO – Notice of Objection; NOA – Notice of Appeal; RAV01 – Registration, Amendment and Verification Form; TDC01- Transfer Duty Declaration; VAT201 – Vendor Declaration Corporate Income tax is compulsory for all trading entities whether they take the form of a sole proprietor, partnership, private company or close corporation. Depending on factors such as turnover, payroll amounts and involvement in imports and exports, you could also be liable to register for other taxes and duties such as VAT, employees' tax, UIF, SDL and customs and excise duties.

Tax Registration with SARS for your Company

Results SARS. SARS eFiling – SARS eFiling Registration, Registration Form, Contact and Important Dates SARS eFiling This free service allows taxpayers, tax practitioners and businesses to register free of charge and submit returns and declarations, make payments and perform a number of other interactions with SARS in a secure online environment., How do I register for tax? Do I need to submit a return? How do I send SARS my return? How do I pay? What if I do not agree? I need help with my tax: Manage your Tax Compliance Status: I want to get a Tax Directive: Foreign Employment Income Exemption: Tax and Starting work : Tax and Retrenchment: Tax and Retirement: Tax and Disability: Tax and Embassies: Tax and Emigration: Tax and Non.

TRCN1 Tax Registration Cancellation Notification

SARS eFiling SARS eFiling Registration Registration. Corporate Income tax is compulsory for all trading entities whether they take the form of a sole proprietor, partnership, private company or close corporation. Depending on factors such as turnover, payroll amounts and involvement in imports and exports, you could also be liable to register for other taxes and duties such as VAT, employees' tax, UIF, SDL and customs and excise duties. https://en.wikipedia.org/wiki/Value-added_tax Registration is manual and a registration form (TT01) must be submitted to a SARS branch. The turnover tax system replaces income tax, provisional tax, capital gains tax and dividend tax. It is worked out by applying a tax rate to a micro business’s turnover on a sliding scale. Key dates for turnover tax.

7. In the event that you receive a letter of demand for payment of income tax from SARS, write them another letter (addressed to the name indicated as the reference at SARS) in which you refer to your submission of a nil return and your previous de-registration letter (attach copies of both). Follow the steps in 5+6 above again. 8. Should you The Income Tax Department NEVER asks for your PIN numbers, passwords or similar access information for credit cards, banks or other financial accounts through e-mail.. The Income Tax Department appeals to taxpayers NOT to respond to such e-mails and NOT to share information relating to their credit card, bank and other financial accounts.

SARS eFiling – SARS eFiling Registration, Registration Form, Contact and Important Dates SARS eFiling This free service allows taxpayers, tax practitioners and businesses to register free of charge and submit returns and declarations, make payments and perform a number of other interactions with SARS in a secure online environment. Registration is manual and a registration form (TT01) must be submitted to a SARS branch. The turnover tax system replaces income tax, provisional tax, capital gains tax and dividend tax. It is worked out by applying a tax rate to a micro business’s turnover on a sliding scale. Key dates for turnover tax

The following Notices of Registration will no longer be issued: IT150 – Notice of Registration [Personal and Corporate Income Tax (CIT)] VAT 103 – Notice of Registration [Value-Added Tax (VAT)] EMP103 – Notice of Registration (Payroll Taxes). Corporate Income tax is compulsory for all trading entities whether they take the form of a sole proprietor, partnership, private company or close corporation. Depending on factors such as turnover, payroll amounts and involvement in imports and exports, you could also be liable to register for other taxes and duties such as VAT, employees' tax, UIF, SDL and customs and excise duties.

How do I register for tax? Do I need to submit a return? How do I send SARS my return? How do I pay? What if I do not agree? I need help with my tax : Manage your Tax Compliance Status: I want to get a Tax Directive: Foreign Employment Income Exemption: Tax and Starting work: Tax and Retrenchment: Tax and Retirement: Tax and Disability: Tax and Embassies: Tax and Emigration: Tax and Non Note: At the time of de registration, the company assets are deemed to be a supply and hence output tax should be declared. Income Tax De-registration. A registered person may at any time de-register or cancel registration for income tax purposes, if the company, business or individual no longer exist. Company or Business De-registration

Corporate Income tax is compulsory for all trading entities whether they take the form of a sole proprietor, partnership, private company or close corporation. Depending on factors such as turnover, payroll amounts and involvement in imports and exports, you could also be liable to register for other taxes and duties such as VAT, employees' tax, UIF, SDL and customs and excise duties. Tax Registration: If a company is registered at CIPC, it needs to be registered for Company Income Tax at SARS. Most company owners distributes ALL (or most) of the company’s profits to the Directors and other stakeholders in the form of salaries and professional fees during the company’s financial year. If the company has any profit by

Also see list of all SARS eFiling forms. Top Tip . Forms will open as .pdf documents. All Forms (alphabetically sorted) ADR1 - Notice of Objection for Trusts and Other Taxes - External (Form) ADR2 - Notice of Appeal for Trusts and Other Taxes - External (Form) APT101 - Agents application for registration cancellation or changing of registered particulars - External (Form) APT102 - Operators This is not to be confused with the CC/PTY’s Income tax number. A registered CC/PTY needs to register with SARS and obtain an income tax number. This can be done by completing the simple form below. Note that you cannot register a CC/PTY for income tax if the CC/PTY has not been registered at the Registrar and obtained a Registration number.

SARS eFiling is a free, online process for the submission of returns and declarations and other related services. This free service allows taxpayers, tax practitioners and businesses to register free of charge and submit returns and declarations, make payments and perform a number of other interactions with SARS in a secure online environment. 30/06/2019 · General disclaimer These tutorial videos are provided to help taxpayers understand their obligations and entitlements under the tax Acts administered by the Commissioner for SARS…

7. In the event that you receive a letter of demand for payment of income tax from SARS, write them another letter (addressed to the name indicated as the reference at SARS) in which you refer to your submission of a nil return and your previous de-registration letter (attach copies of both). Follow the steps in 5+6 above again. 8. Should you Tax Registration Verification @ Only R490 Do you require Tax Registration Verification for your Company in South Africa? Our Tax Registration Verification service includes the following: Activation of your Company’s SARS E-filing Profile, communicating your Company’s Tax Number to you, uploading your Company’s Banking Details to SARS, appointment of the Public Officer, and verification

A: In our view the body corporate must complete the company registration form IT77c to register for income tax and submit it at the local SARS branch (See IN 64 at 5.1.). The section 10(1)(e) of the Income Tax Act exemption for body corporate levies and partial exemption for non-levy income. SARS Services. The South African Revenue Services (SARS) requires all South African Companies to register for Tax. We offer our Clients across South Africa Company Tax Services which include Tax Registration / Verification / Clearance / VAT and much more.

Area code Application for Registration as a Taxpayer or Changing of Registered Particulars: Individual Ta xpayer ref. no. IT77 Taxpayer Information Personal Details Surname Contact Email TPINF01 First Two SARS eFiling is a free, online process for the submission of returns and declarations and other related services. This free service allows taxpayers, tax practitioners and businesses to register free of charge and submit returns and declarations, make payments and perform a number of other interactions with SARS in a secure online environment.

Tax Season for Individuals (including guides, forms & faq's) Do I need to submit a return? What if I receive income from two sources? Do you need help with eFiling? Try our Help-you-eFile service. Or try our smartphone app; How do I send SARS my tax return? What if I don't agree? How do I pay? I forgot my eFiling password; I need my tax number Tax Season for Individuals (including guides, forms & faq's) Do I need to submit a return? What if I receive income from two sources? Do you need help with eFiling? Try our Help-you-eFile service. Or try our smartphone app; How do I send SARS my tax return? What if I don't agree? How do I pay? I forgot my eFiling password; I need my tax number